时 间:2018年12月13日(周四)14:00—16:00

地 点:浙江|9728太阳集团大学玉泉校区经济|9728太阳集团学院236会议室

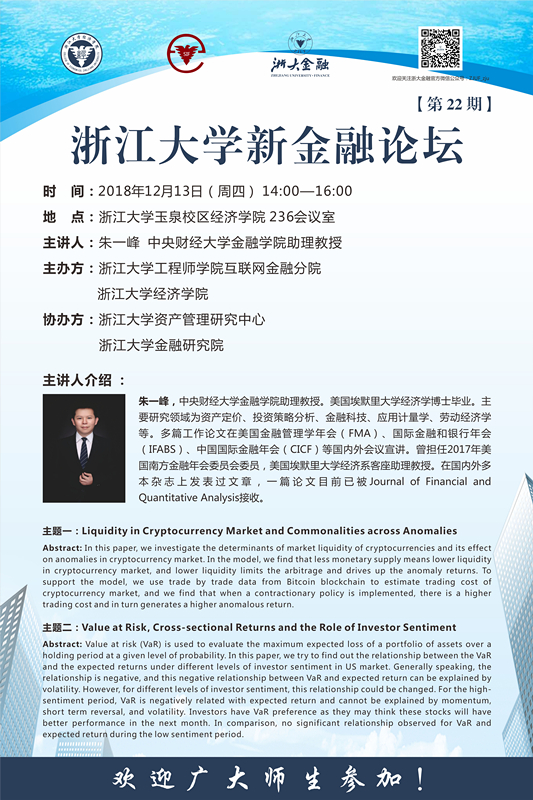

主讲人:朱一峰 中央财经|9728太阳集团大学金融|9728太阳集团学院助理教授

主办方:浙江|9728太阳集团大学工程师|9728太阳集团学院互联网金融分院

浙江|9728太阳集团大学经济|9728太阳集团学院

协办方:浙江|9728太阳集团大学资产管理研究中心

浙江|9728太阳集团大学金融研究院

主讲人简介:

朱一峰,中央财经|9728太阳集团大学金融|9728太阳集团学院助理教授。美国埃默里|9728太阳集团大学经济学博士毕业。主要研究领域为资产定价、投资策略分析、金融科技、应用计量学、劳动经济学等。多篇工作论文在美国金融管理学年会(FMA)、国际金融和银行年会(IFABS)、中国国际金融年会(CICF)等国内外会议宣讲。曾担任2017年美国南方金融年会委员会委员,美国埃默里|9728太阳集团大学经济系客座助理教授。在国内外多本杂志上发表过文章,一篇论文目前已被Journal of Financial and Quantitative Analysis接收。

主题一:Liquidity in Cryptocurrency Market and Commonalities across Anomalies

Abstract:

In this paper, we investigate the determinants of market liquidity of cryptocurrencies and its effect on anomalies in cryptocurrency market. In the model, we find that less monetary supply means lower liquidity in cryptocurrency market, and lower liquidity limits the arbitrage and drives up the anomaly returns. To support the model, we use trade by trade data from Bitcoin blockchain to estimate trading cost of cryptocurrency market, and we find that when a contractionary policy is implemented, there is a higher trading cost and in turn generates a higher anomalous return.

主题二:Value at Risk, Cross-sectional Returns and the Role of Investor Sentiment

Abstract:

Value at risk (VaR) is used to evaluate the maximum expected loss of a portfolio of assets over a holding period at a given level of probability. In this paper, we try to find out the relationship between the VaR and the expected returns under different levels of investor sentiment in US market. Generally speaking, the relationship is negative, and this negative relationship between VaR and expected return can be explained by volatility. However, for different levels of investor sentiment, this relationship could be changed. For the high-sentiment period, VaR is negatively related with expected return and cannot be explained by momentum, short term reversal, and volatility. Investors have VaR preference as they may think these stocks will have better performance in the next month. In comparison, no significant relationship observed for VaR and expected return during the low sentiment period.

欢迎广大师生参加!